The Building Blocks of a Digital Insurance Product

In an era where digital transformation is no longer optional, insurance executives are acutely aware of the shift occurring in product distribution. While the traditional agent-centric model is still relevant, it is rapidly giving way to a more dynamic, technology-driven approach.

Insurance product digitalization for distribution goes far beyond simply offering online quotes or mobile apps. It represents a fundamental restructuring of how digital insurance products are defined, priced, and delivered to consumers. This shift demands a deep understanding of the intricate components that make up a robust digital insurance ecosystem. From data structures to sophisticated business rules, from seamless customer journeys to dynamic pricing models, each element plays a crucial role in efficient digital insurance product distribution strategy.

Democrance already helped dozens of insurance players to achieve outstanding results in digital insurance sales & distribution. How?

Let us explain the crucial digital product building framework.

The Five Pillars of Digital Insurance Product

The digital insurance landscape is built upon five foundational elements, each playing a crucial role in creating a seamless, efficient, and customer-centric distribution system. Let’s explore these building blocks in detail:

1. Data Structures

Data is the lifeblood of insurance operations in the digital age. How insurance risk data is defined and collected can make or break an insurer’s digital transformation efforts.

At the core of any digital insurance product lies in its data structure. When defining insurance product data structures you have to consider data needed during all insurance policy lifecycle: new sales, endorsements, terminations and renewals.

Data structures should cover all the different stages of insurance sales, obviously – different data might be required for quotation and policy bound stages.

An idea framework to understand what data we need for digital insurance product definition is to look through 3 lenses of insurance policy activities:

- What data points do we need for insurance price calculation (rating)?

- What data points are obligatory to present in documents generated during different policy journeys?

- What data points need to be presented in different reports? Operational and analytical reports should be considered in this case.

The challenge lies in creating a structure that is both comprehensive enough to support all insurance business flows and mandatory technical insurance product administration, thus avoiding double entries.

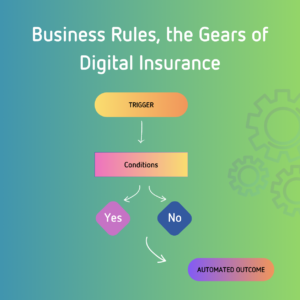

2. Business Rules

While data structures provide the foundation, business rules are the gears that makes the digital insurance product dynamic, ensuring that every process follows predefined logic and eliminating redundant manual operations by making them automatic.

These rules manage every aspect of the insurance journey, from simple presets of default values or 3rd party data loading to final insurance rate calculation and required documents generation.

Key components include:

- Triggers: Events that initiate specific rule’s processes (e.g., quote started, specific action initiated, policy)

- Conditions: Criteria that must be met for certain actions to occur (e.g., selected specific product, required insurance limit is higher that X amount)

- Actions: Automated outcome of the rule based on triggers and conditions (e.g., quote status change, document generated, quote price is calculated)

Rules engine must be capable of handling complex, multi-variable decisions in real-time.

When we think about the rules – we should use them for any dynamic/logic that is executed either manually or automatically in cooperation with other building blocks of digital insurance products.

Application of the rules concept is much wider and its not limited to the internal building blocks of insurance products. Rules are also considered in integrations with 3rd party systems: various governmental data sources, external risk coefficients databases, other rating engines or national databases for logging insurance covers.

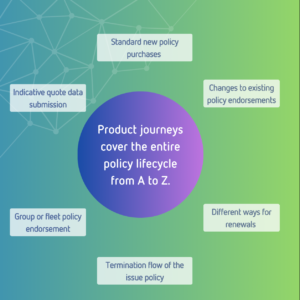

3. Product Journeys (and UX)

“Same type” insurance products from different insurers have a lot of similarities. It’s becoming more and more challenging for insurers to stand out.

The key is not only what you offer in terms of insurance cover, but how you present it and what is the customer’s experience and the customer’s journey during the policy sales process. How clearly data is presented for entry, in which order is the data collected, how many data points are needed, thus considering only essential fields and eliminate redundant (not important) collection of data.

Product journeys help to break down insurance product data structures in small and end user understandable steps. This provides the user a feeling of progress during the insurance quote submission process, as some quotes might be really complex (think, for instance, about commercial insurance).

In reality, product journeys extend far beyond the point of new policy sale. They encompass the entire policy lifecycle from A to Z, including:

- Indicative quote data submission

- Standard new policy purchases

- Changes to existing policy endorsements

- Group or fleet policy endorsement (updating members or vehicles)

- Termination flow of the issue policy

- Different ways for renewals of existing policies.

Each journey has specific targets to meet in the insurance policy lifecycle and provide intuitive and focused UX experience towards that target.

Different digital distribution channels (broker portal, direct web sales, or API-driven partnerships) require different sequences of data entry and some data points might even be eliminated (depending on distributions channels). In this case, product journeys’ configuration should easily cope with these exceptions across different distribution channels.

Modern product journeys should be recommendation driven, leveraging AI capabilities, anticipating potential clients’ needs and proactively offering additional insurance coverage depending on the client’s personal profile and current needs.

4. Rater & Price Calculation

Pricing in digital insurance is no longer a manual exercise (of course, exceptions might apply for really complex and edge cases). It’s a dynamic, real-time process that requires automation of underwriting algorithms and various logical conditions.

Beyond basic quote premium calculations, advanced systems should also breakdown offered premium into agent commission, gross commission, taxes and other reinsurance costs, regulatory compliance checks and profitability analysis and many other factors as well.

Underwriters love Excel. They use Excel to define rating engines, thus modern rater engines should be capable of incorporating pre-made Excel files into their general rating logic. In this case, rating logic is pretty straightforward – it accepts provided inputs from data structure, creates pricing and other outcome calculation and returns output fields, which can be pushed back to existing data structures.

Modern and personalized digital insurance products need dynamic pricing models that can adjust in real-time based on changing risk factors and integration with external data sources for more accurate risk assessment.

5. Documents

Despite the move towards digitalization, the documentation factor remains a critical component of insurance operations, serving both legal and communication purposes. During the policy lifecycle, additional documents for endorsements, termination and renewals should be produced as well.

Documents and legal conditions are changing fast, thus – digital platforms should be able to separate: a) document template definitions; b) generation of final documents from given templates.

The documents in the policy lifecycle might be either dynamic or static (like standard wordings and informational type document).

A robust digital system should be capable of generating personalized documents dynamically based on collected data structures, supporting digital signatures and a secure electronic delivery, ensuring version control and regulatory compliance.

Summary – Benefits of Digital Distribution

Digital transformation in insurance involves more than just online quotes submission forms; it fundamentally restructures how products are defined, priced, and delivered.

Key components include robust data structures, automated business rules, and optimized product journeys that enhance user experience. Dynamic pricing models and efficient document generation further streamline operations, making the entire process more accurate and customer-centric. These building blocks enable insurers to effectively distribute digital products, driving efficiency and engagement in the modern insurance landscape.

Insurers who are going to thrive are those who view digital transformation not as a one-time project but as an ongoing journey of innovation and adaptation.

We at Democrance specifically defined, mastered and launched (with multiple insurance clients) this digital insurance building concept to provide a solid foundation and real differentiator. This foundation shows insurance companies how to create unique value propositions and seamless customer experiences.

Let’s talk!

Find out how Democrance can help transition your company from traditional to the digital distribution insurance age!